The Break of Structure (BoS) is one of the most potent concepts that can alleviate this perplexity. Understanding this single term could significantly enhance your perspective on the markets, regardless of whether you are a price action trader or delve into Smart Money Concepts (SMC).

This article will provide a comprehensive examination of Break of Structure, including its definition, functioning, application in trading, advantages and disadvantages, and frequently asked questions. Let us commence.

What is the definition of a “break of structure”

Break of Structure (BoS) is a term that denotes a scenario in which the market breaches a previously established level of market structure, such as a support or resistance level, or, more specifically, higher highs or lower lows in a trending market.

To put it simply:

- A break of structure occurs in an uptrend when the price fails to reach a higher high and instead produces a lower low.

- A break of structure occurs in a downtrend when the price fails to make a lower low and instead makes a higher peak.

The result suggests a potential change in market orientation, such as a temporary pullback or a trend reversal.

Market Structure Shift (MSS) vs Break of Structure

BoS is frequently confused with another term, Market Structure Shift (MSS).

- The break of structure typically occurs in accordance with the present trend, indicating a continuation.

- Market structure shifts frequently indicate a reversal, indicating that the power dynamic between buyers and vendors is evolving.

Both are significant, but BoS serves as the foundation of market structure-based trading.

Breaks of Structure: Different Types

We can further deconstruct it:

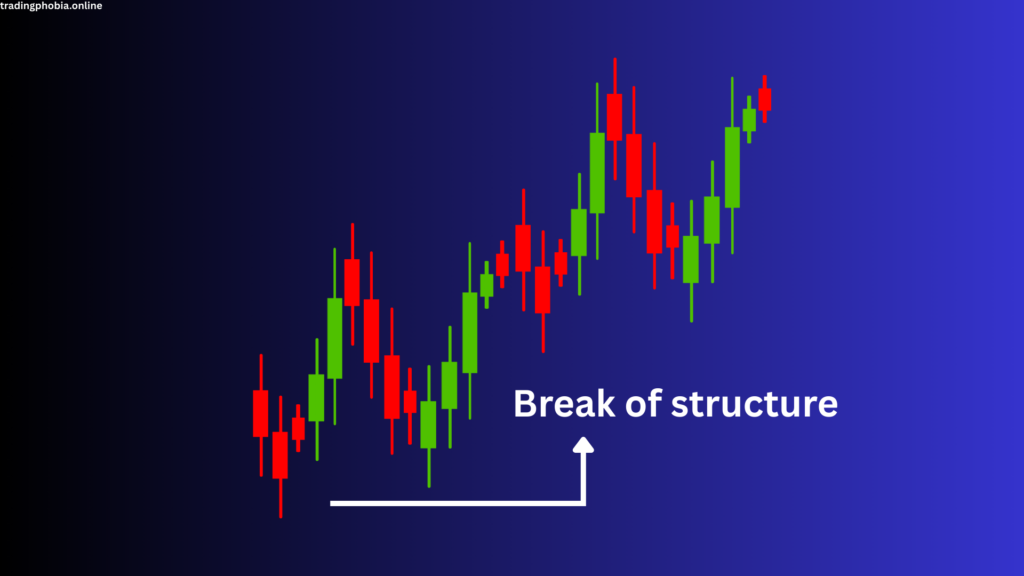

1. Bullish Break of Structure (BoS Up)

Takes place when:

- The market surpasses its most recent record high.

- It demonstrates the continuation of the trend and the robust momentum of buyers.

- Traders have the option to establish long positions following the break.

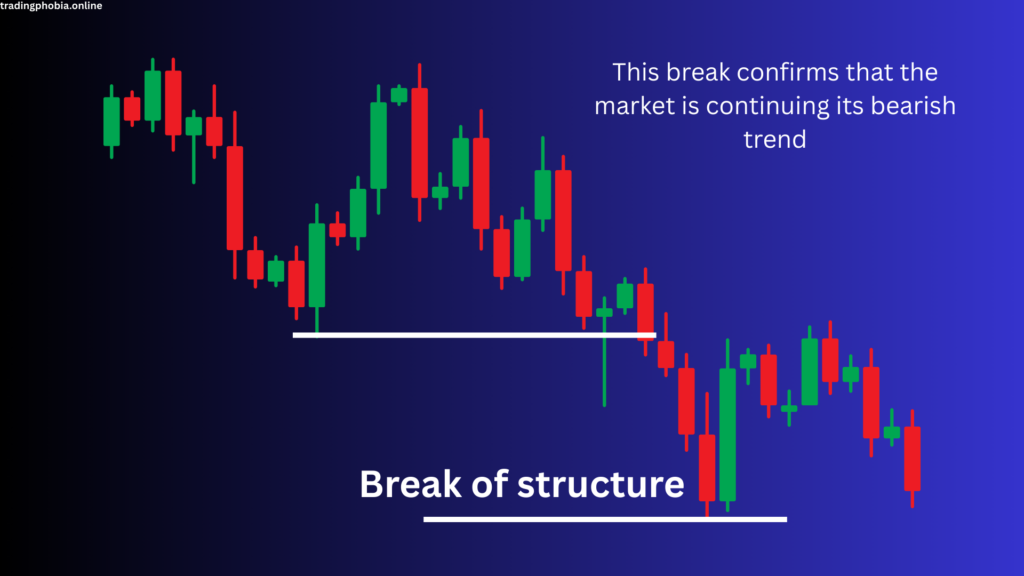

2. Bearish Break of Structure (BoS Down)

Takes place when:

- The market breaks above an earlier lower low.

- It demonstrates the continuance of the downtrend and the strength of the seller.

- Shorting opportunities may be pursued by traders.

The Significance of Structure Breakdown

Some of you may be wondering, “Isn’t this process simply the breaking down of support and resistance?” Certainly, but also no. BoS provides you with confirmation and context. It is an extremely valuable indicator in a world characterized by manipulation and fake-outs, as it indicates that the market has made a decision.

The following is the reason for its effectiveness:

- It confirms the continuation or reversal of a trend.

- It serves as a signal for the entry or departure of trades.

- The system assists in preventing the early or late entry.

- It is extensively utilized in Smart Money Concepts (SMC) for institutional-level trading.

Methods for Detecting a Break in Structure in a Chart

- Determine the trend: Are you experiencing an uptrend, downtrend, or ranging market?

- Look for recent highs and lows and mark key structure points.

- Monitor the break and wait for the price to surpass the previous structure level before closing.

- Verify the information using candlestick patterns or volume. Observe for strong momentum, such as high-volume surges or engulfing candles.

- Optional retest entry: The price frequently returns to the broken level for a retest. This option is a more secure entry.

Tools to Use for Confirming BoS

- Price Action: Examine the behavior of candles in relation to critical levels.

- Volume Analysis: The presence of a substantial volume of data indicates that there are genuine breaches.

- Fibonacci Retracement: Determine whether the BoS is consistent with the critical fib levels.

- SMC Tools: Liquidity levels, order blocks, and fair value gaps.

Example of a Structure Break

Suppose you are trading EUR/USD on the 1-hour chart:

- The price is currently experiencing an upward trend, with an increase in both the high and low points.

- Suddenly, the price fails to establish a new high and instead plummets below the most recent higher low.

- This break of structure is a sign that purchasers are losing control and that sellers may be intervening.

- Waiting for a retest of the broken level, you execute a short trade with appropriate risk management.

Pros and cons of break of structure

Pros:

- Market Clarity: Facilitates comprehension of market intention (continuation versus reversal).

- Entry and Exit Signals: Offers compelling arguments for entering or exiting a trade.

- Risk Management: Facilitates the placement of stop-losses, which are typically located just beyond the damaged structure.

- Combines with Other Strategies: May be combined with SMC, Fibonacci, or supply/demand concepts.

- BoS is beneficial for both swing trading and scalping, as it operates on all timeframes.

Cons:

- False Breakouts: Markets can simulate a BoS and promptly reverse it.

- Lagging Nature: The majority of the relocation may have been completed by the time the hiatus occurs.

- Experience is necessary. It is necessary to establish that not all BoS signals are equivalent.

- Market Noise: The accumulation of an excessive number of BoS signals in lower timeframes can result in confusion.

- Subjectivity: Your definition of a “structure” level may differ from that of another trader.

Pro Tips for Mastering BoS

- Zoom Out: Do not rely solely on the current timeframe. Consider confluence over longer periods.

- Mark Major Highs/Lows: Concentrate on the substantial peaks; not every minor peak is significant.

- Utilize SMC Concepts: For high-probability setups, combine BoS with liquidity captures and order blocks.

- Keep a record of your transactions. Record each BoS trade, regardless of whether it results in a gain or a loss, to identify trends in your performance.

- Refrain from overtrading: The mere presence of a Bollinger Band (BoS) does not necessitate the execution of a trade on every occasion.

Break of Structure FAQs

1. Is Break of Structure a signal of reversal?

It is not always the case. Continuation or reversal can be indicated by BoS, contingent upon the context. Continuation is typically indicated when the market breaks in the direction of the trend. It may suggest a reversal if it deviates from the trend.

2. What is the difference between market structure shift and break of structure?

BoS is the continuation of the present trend.

MSS = Potential trend reversal. Although both are structure-based signals, they convey distinct narratives.

3. Is it feasible to implement BoS in the realms of Forex, cryptocurrency, and stocks?

This is undeniably true. Structure is a concept that is applicable to all markets. BoS is applicable regardless of whether you are trading EUR/USD, BTC/USDT, or AAPL.

4. How can I prevent the occurrence of fraudulent breakouts?

Confirmation should be conducted within longer timeframes.

Seek confluence with volume, liquidity zones, or candlestick patterns.

Wait until the candle has closed beyond the level, not just the wick.

5. Would it be possible to automate the detection of BoS?

Indeed, certain indicators and trading instruments are capable of identifying BoS. But when it comes to reading price context, human eyes still perform better than machines.

Break of Structure Conclusion

One of the most potent yet underappreciated instruments in technical analysis is the break of structure. It assists traders in the decoding of market behavior, the logical planning of transactions, and the avoidance of emotional decisions.

While no strategy is perfect, integrating BoS with appropriate confirmation and a risk management plan can significantly increase the success rate.

Therefore, the next time you access your chart, refrain from gazing at the candles. Begin the process of mapping the structure, anticipate the breach, and trade with confidence.