Candlestick types play a crucial role when it comes to trading, these different forms of candlesticks are quite important in terms of technical analysis. They offer extremely helpful insights into the sentiment of the market, the direction of prices, and the possibility of price reversals.

Having an awareness of the various types of candlesticks will assist you in making more educated judgments regarding your trading, regardless of whether you are a novice or an experienced trader. In this guide, we will discuss the many varieties of candlesticks, in addition to their meanings and the ways in which they can be utilized effectively in trading.

During a given period of time, the open, high, low, and close prices of an asset are what create the candlestick patterns that are associated with that asset. Market mood can be indicated by these patterns, which can either be bullish or bearish, thereby assisting traders in predicting potential price changes.

Candlesticks can be broken down into several categories, the most frequent of which are the doji, hammer, enveloping, and shooting star. As a result of the fact that each of these patterns conveys a distinct narrative regarding the conflict between buyers and sellers, technical traders make use of them as indispensable tools.

A hammer candlestick, for instance, makes its appearance following a downward trend and indicates that there is a possibility of a reversal to the upside. This indicates that sellers were able to drive the price down before buyers were able to regain control of the situation. It features a tiny body with a long lower wick.

A shooting star, on the other hand, is the reverse of a falling star; it appears after an upward trend and indicates that a probable bearish reversal may be occurring. It is characterized by a short body and a lengthy upper wick, which indicates that purchasers made an effort to drive up prices but were ultimately rendered ineffective by sellers. It is possible for traders to improve the timing of their entries and exits by being familiar with the different types of candlesticks.

In order to have a complete understanding of candlestick patterns, it is not enough to simply memorize their forms; one must also analyze them in relation to the general market movements, volume, and support and resistance levels. Increasing the accuracy of candlestick analysis and decreasing the number of false signals can be accomplished by combining it with other technical indicators such as moving averages or RSI. Through the incorporation of these patterns into a comprehensive trading strategy, traders are able to get more profound insights into the dynamics of the market and make judgments that are also more informed.

Which Types of Candlesticks Are There?

Different patterns created by price fluctuations on a trading chart are referred to as candlestick types. Every candlestick displays the opening, closing, high, and low prices for a given time period. These patterns are used by traders to assess market trends and forecast future price changes. While some candlestick types suggest possible reversals, others show the continuation of a trend.

Knowing whether a pattern points to a potential reversal or the continuance of the present trend is one of the most crucial components of candlestick analysis. For example, morning star and bullish engulfing patterns suggest that buyers are becoming stronger and suggest a possible upside reversal.

On the other hand, patterns such as the evening star or bearish engulfing signal a potential downside reversal and alert traders to potential selling pressure. Traders can make more informed decisions about entering or quitting transactions by recognizing these patterns.

Additionally, when paired with other technical indicators like Bollinger Bands, RSI (Relative Strength Index), and moving averages, candlestick patterns become even more useful. This combination lowers the possibility of inaccurate forecasts and aids in signal confirmation.

For instance, the likelihood of a bullish reversal is increased if a hammer candlestick forms close to a strong support level with an oversold RSI. Traders can improve their trading accuracy and methods by comprehending these patterns and how they fit into the larger market structure.

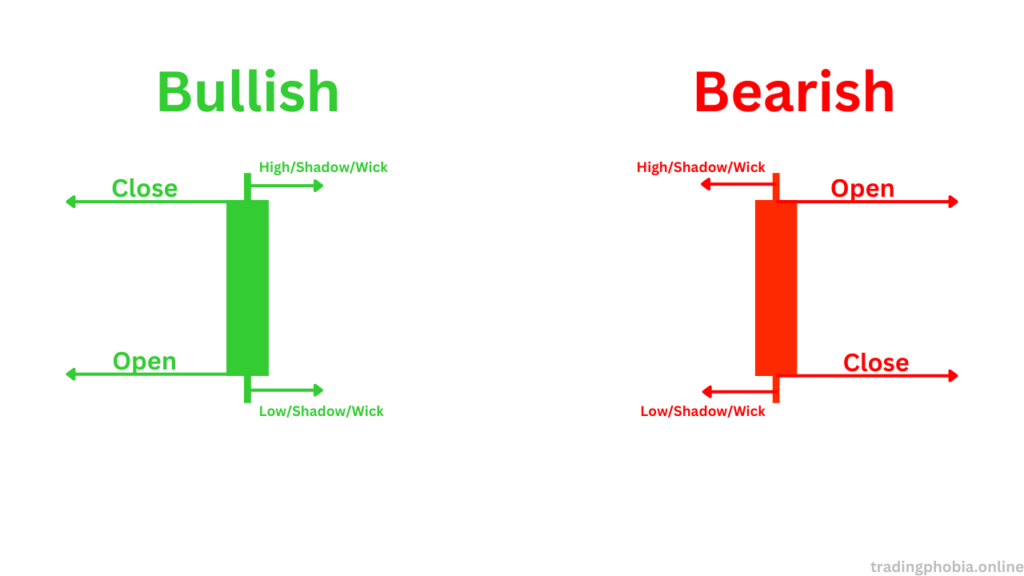

Basic Candlestick Structure

Before delving into the various candlestick kinds, it’s important to understand their structure. Each candlestick has three essential components:

- Body: Shows the opening and closing prices.

- Wick (Shadow): Indicates the top and lowest prices for the period.

- Color: A green (or white) candle indicates that the closing price was higher than the opening price (bullish), whereas a red (or black) candle suggests a lower closing price (bearish).

Single candlestick patterns

Single candlestick patterns are characterized by a single flame and can generate significant trading signals.

- Doji Candlestick

A Doji is formed when the opening and closing prices are nearly identical, resulting in a small or nonexistent body. This candlestick type frequently precedes trend reversals and indicates market indecision.

Doji Candlestick Types

- neutral doji: represent uncertainty. .

- Dragonfly Doji: Indicates the possibility of a bullish reversal.

- Gravestone Doji: Indicates a pessimistic reversal.

- Doji with long legs: Demonstrates a significant lack of certainty.

- Hammer and Inverted Hammer

These candlestick types are indicative of a prospective bullish reversal and are observed at the conclusion of a downtrend.

- Hammer: The presence of a long lower wick and a small body indicates that buyers are acquiring control.

- Inverted Hammer: A candlestick pattern that is similar to the hammer, but with a longer upper flame, which may indicate the emergence of bullish momentum.

- Shooting Star and Hanging Man

In contrast to hammer formations, these candlestick patterns suggest bearish reversals.

- Shooting Star: A compact body with a long upper wick that is located at the peak of an uptrend.

- Hanging Man: Indicates the potential for a downtrend by appearing at the apex of an uptrend.

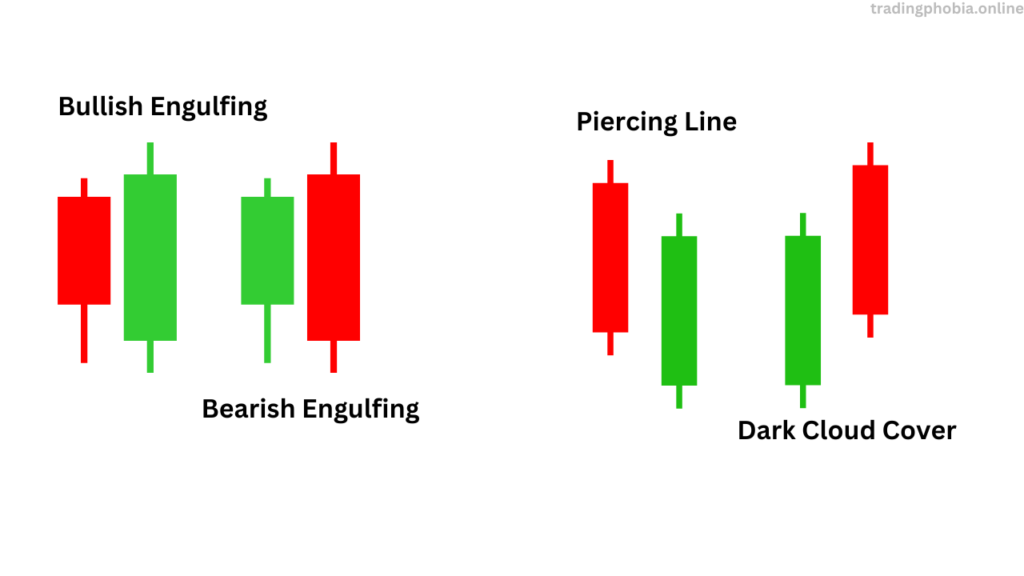

Double candlestick patterns

Double candlestick patterns are characterized by the presence of two consecutive flames, which serve as stronger indicators of potential trend shifts.

- Bullish and Bearish Engulfing

Engulfing patterns are potent reversal signals in which a larger candle completely engulfs the previous one.

- Bullish Engulfing: A potential uptrend is indicated by the presence of a large green candle that envelops a smaller red candle.

- Bearish Engulfing: A bearish trend is indicated when a large red candle engulfs a smaller green candle.

- The Piercing Line and the Dark Cloud Cover

- Piercing Line: A bullish reversal pattern in which the midpoint of the previous red candle is exceeded by a green candle.

- Dark Cloud Cover: A bearish reversal pattern in which a red candle closes below the midpoint of the previous green candle.

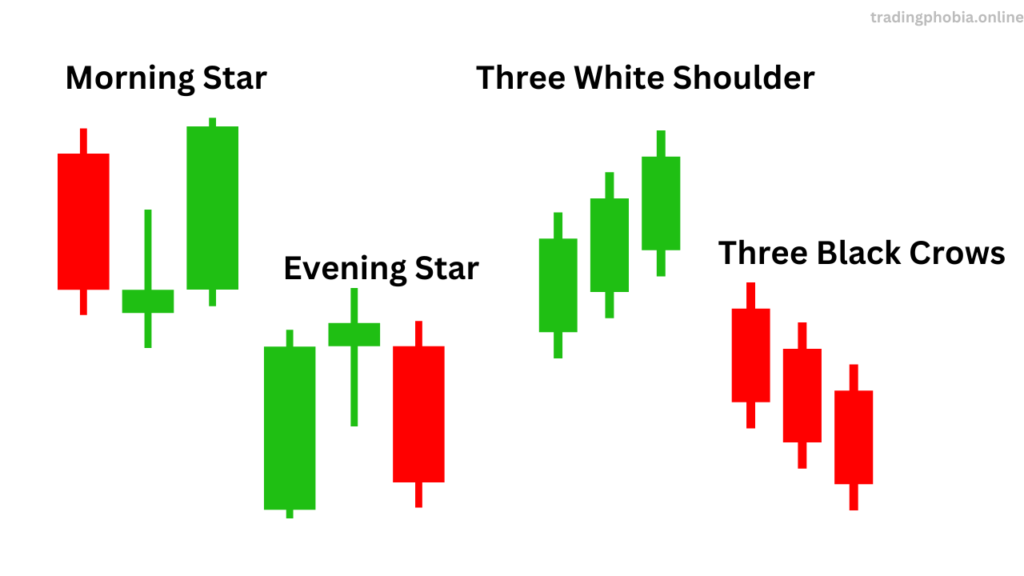

Triple Candlestick Patterns

Triple candlestick patterns offer even more robust indicators of prospective trend shifts.

- Morning and evening stars

- Major trend reversals are indicated by star patterns.

- Morning Star: A three-candle pattern that indicates a shift from adverse to bullish sentiment.

- Evening Star: A turning point from bullish to bearish.

- Three White Soldiers and Three Black Crows

These candlestick patterns are potent trend indicators.

- Three White Soldiers: A bullish trend is indicated by three consecutive lengthy green candles.

- Three Black Crows: A bearish trend is indicated by three consecutive red flames.

How to Trade Using Different Types of Candlesticks

Candlestick types must be understood, but accuracy is increased by combining them with additional indicators such as volume analysis, RSI, and moving averages. Here are some important pointers:

Seek confirmation:

When making trading decisions, don’t depend just on one candlestick pattern. Always look for corroborating signs from price action patterns or other indicators. For instance, use an oversold RSI or rising volume to confirm the reversal if a bullish engulfing pattern develops close to a strong support level.

Make use of trendlines:

Determining the levels of support and resistance improves the quality of your analysis. Usually, a candlestick pattern that forms at these crucial levels is more significant. For example, the probability of a price recovery is increased if a hammer shows up at a long-term support level.

Combine with indicators:

Candlestick types can be made more successful by utilizing technical indicators such as RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence). The sell signal is strengthened, for instance, if an evening star pattern develops and the MACD displays a bearish crossover.

Analyse volume:

Volume is essential for validating candlestick patterns. Strong buying interest is indicated by a high-volume bullish engulfing pattern, which increases the reversal’s dependability. On the other hand, a low volume pattern could be a sign of poor conviction.

Traders can create a more solid strategy and increase their chances of making good trades by combining candlestick analysis with additional tools.

How to Reading a Candlestick Chart

Analyzing market trends and making wise selections in trading depend on a knowledge of a candlestick chart. Every candlestick shows a different time period and offers vital price information including opening, closing, high, and low values.

First: Learn about the candlestick structure.

- The body shows the opening and closing prices’ variations. While a red (or black) body indicates a bearish movement—price closed lower than it opened—a green (or white) body shows a bullish movement—price closed higher than it opened.

- The Wick, or Shadow, shows the highest and lowest prices over the time on the thin lines above and below the body.

Second step: Determine trend direction.

- Should you come across several green candles, the market is in an upswing.

- Should red candles predominate, there is a decline.

- She said: Both signals consolidation or market indecision mixed together.

Third Step: Identify Candlestick Patterns

- Candlestick forms such Doji, Hammer, Engulfing, and Morning Star offer information on possible trend reversals or continuencies. As such:

- A doji indicates uncertainty.

- An approaching rise is suggested by a bullish engulfing.

The fourth step is applying indicator-based Candlestick Styles.

- Combining technical indicators as Moving Averages, RSI, or MACD with candlestick analysis will help to improve accuracy. Levels of support and opposition also assist to validate trends.

Mastery of candlestick charts helps traders to properly forecast market fluctuations and improve their techniques for better trading decisions.

Candlestick Types Pros & Cons

Pros

- 1. Simple to Understand Compared to conventional line charts, candlestick charts offer a visual depiction of price fluctuations, which facilitates the identification of trends and patterns.

2. Good at Recognizing Trends Understanding reversal, bearish, and bullish patterns aids traders in making well-informed choices on when to enter or exit deals.

3. Functions Across Time Candlestick analysis can be used for a variety of time periods, ranging from daily or weekly charts for long-term trading to minute charts for scalping.

4. Improves Analysis of Market Sentiment Trader psychology is shown by patterns like Doji, Hammer, or Engulfing, which show whether buyers or sellers are in charge.

5. Blends Well with Other Measures For more precise forecasts, candlestick types combine well with technical indicators such as Bollinger Bands, Moving Averages, RSI, and MACD.

Cons

- 1. Necessitates practice and experience If not analyzed correctly, candlestick patterns can be deceptive, particularly for novice traders.

2. False Signals Occur Traders must employ supplementary confirmation tools to mitigate risk, as not all patterns result in the anticipated outcome.

3. Standalone application is restricted. Candlestick charts may not be sufficient in isolation; traders should integrate fundamental analysis and other market factors to enhance their precision.

4. Capable of Being Subjective Traders may interpret certain patterns, such as Head and Shoulders or Triangles, in a manner that results in inconsistent conclusions.

5. Slightly less effective in markets with low volatility Candlestick signals may be unreliable or inconsequential when the market lacks momentum or volume.

Candlestick Types Conclusion

For any trader who wishes to make well-informed market decisions, it is imperative to acquire the ability to interpret a candlestick chart and master the various types of candlesticks. Candlestick charts are one of the most frequently employed instruments in technical analysis, as they offer valuable insights into price movements, trends, and potential reversals.

Traders can identify critical market signals, including Doji for indecision, Engulfing patterns for reversals, and Three White Soldiers for strong uptrends, by comprehending single, double, and triple candlestick patterns. Each pattern conveys a narrative regarding market sentiment, regardless of whether it is optimistic, bearish, or uncertain.

It is essential to identify the body, flame, and color of the candles when interpreting a candlestick chart. The strength of purchasing or selling pressure is revealed by these elements. Moving Averages, RSI, and MACD are indicators that can be used to improve trading accuracy by integrating candlestick types with support and resistance levels, as well as identifying trends.

Nevertheless, candlestick analysis should not be employed in isolation. Traders should verify patterns with other technical tools and market conditions to achieve optimal outcomes. Building confidence in the ability to effectively interpret candlestick types can be achieved by practicing with historical charts and backtesting strategies.

In conclusion, traders are granted a significant advantage in predicting price movements through the use of chart reading skills and candlestick types. Mastering these concepts can enhance decision-making and increase the likelihood of successful transactions, regardless of whether one is a novice or an experienced trader. Continue to learn, refine your strategies, and incorporate candlestick patterns into your trading approach as a fundamental component.