CHOCH “Change of Character” is a critical instrument for comprehending the market’s behavior, in addition to the numerous concepts that traders employ to forecast market trends.

In the realm of trading, the capacity to analyze and interpret price fluctuations is essential for the purpose of making profitable decisions.

What is Change of Character (CHOCH)?

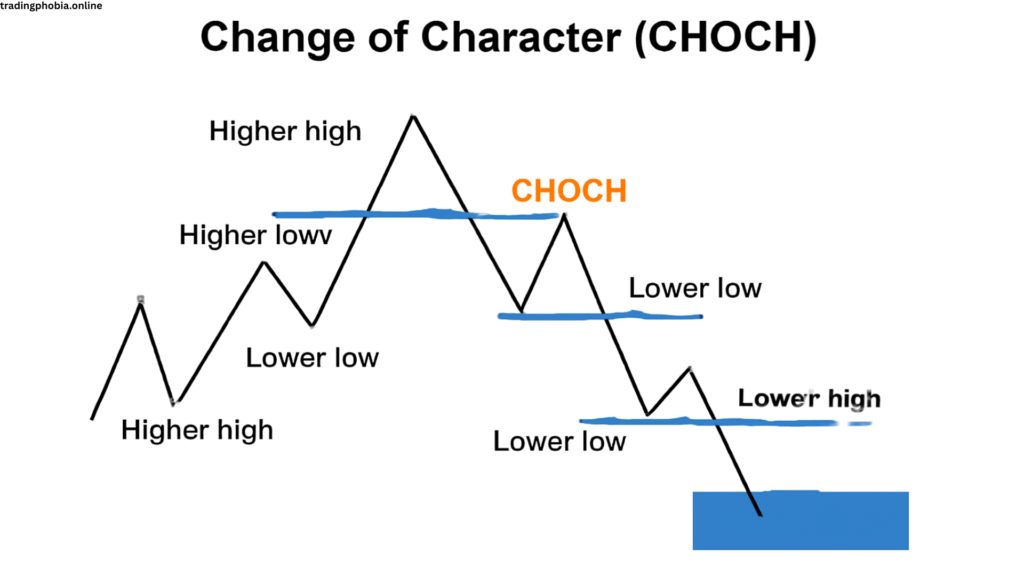

A sudden change in the behavior or trend of a financial asset, referred to as a “change of character” (CHOCH), is typically observed in price action. It suggests that the current market sentiment has been reversed or altered. CHOCH is employed by traders to identify prospective turning points in the market, which indicate a transition from one phase of a trend to another.

This transformation may transpire at various market trends, including the conversion of an uptrend to a downtrend or the reverse. It is crucial to identify a CHOCH, as it indicates that the market dynamics have changed and the preceding trend may no longer be valid.

In essence, CHOCH enables traders to modify their strategies in response to changing market conditions, thereby reducing risk and capitalizing on profitable opportunities.

How to Identify CHOCH in Trading?

The identification of CHOCH demands careful investigation of price fluctuations and patterns. The following are several critical indicators and procedures that can assist traders in identifying a CHOCH:

- Trend Reversal: The abrupt reversal in price direction is one of the primary symptoms of CHOCH. For instance, in an uptrend, the price may breach a support level, while in a downtrend, it may breach a resistance level. This implies a change in market sentiment.

- Structure Break: A structural break occurs when the price fails to establish higher highs in an uptrend or lower lows in a downtrend. The price action’s breach of these levels is a substantial indicator of a potential CHOCH.

- Volume Analysis: A CHOCH can be confirmed by an increase or decrease in trading volume. A reversal is frequently accompanied by a sharp volume increase, which indicates a change in character.

- Candlestick Patterns: The market’s character can be indicated by specific candlestick formations, including engulfing patterns, doji, and hammer candlesticks. These patterns are frequently employed in conjunction with other indicators.

- Confirmation of Time Frame: Traders employ various frames to verify a CHOCH. On a larger timeframe (such as daily or weekly), a pattern or break typically conveys more weight than one on a smaller timeframe (such as 5-minute or 1-hour charts).

CHOCH in Comparison to Other Market Indicators

Although CHOCH is a valuable concept, it is crucial to compare it to other trading indicators. CHOCH is different from conventional technical indicators, such as the Moving Average Convergence Divergence (MACD) or the Relative Strength Index (RSI). It is more concerned with structural movements in the market and price action.

Other indicators may offer particular signals (overbought/oversold conditions, moving averages), but they may not always effectively capture the subtle changes in market character that CHOCH emphasizes. The accuracy of traders’ decisions is frequently enhanced by the combination of CHOCH with other indicators for confirmation.

What transpires subsequent to a Change of Character in Trading?

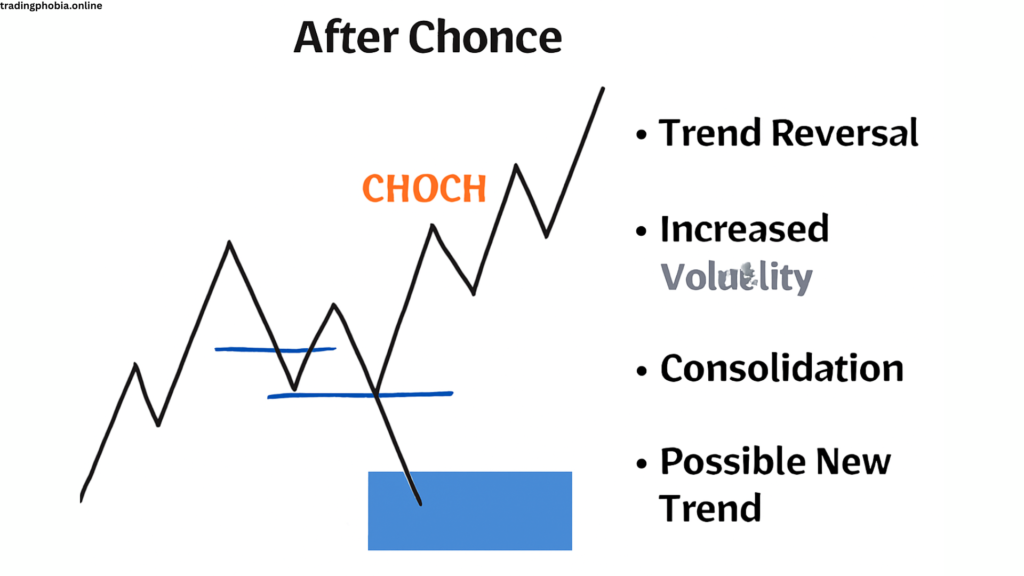

A Change of Character (CHOCH) in the market frequently signifies a critical juncture in price action, indicating the possibility of a trend reversal or a change in market dynamics.

Traders can capitalize on new opportunities and modify their strategies by understanding what typically happens after a CHOCH. Let us delve further into the sequence of events that typically transpire following a CHOCH.

Transition to a New Trend:

The market frequently transitions from the preceding trend to a new one after a change of character has been confirmed. For instance, the price may commence to decline in the event of a CHOCH in an uptrend, indicating the initiation of an adverse trend. In the same vein, the market may reverse and transition to an uptrend if a CHOCH occurs following a downtrend. The establishment of this new trend is typically a slow process; however, it frequently gains momentum as market participants adjust to the change in character.

Traders who identify the change of character at an early stage may enter positions that are consistent with the new trend, thereby establishing themselves for potential profits.

The new trend may initially appear weak or uncertain; however, it acquires strength upon confirmation of additional price action, such as sustained breaks of support or resistance levels. This phase is the point at which trend-following strategies can be highly effective.

Market Noise and Enhanced Volatility

The volatility of markets can frequently increase following a CHOCH, particularly if the trend reversal is abrupt.

As market participants acclimate to the new market conditions, prices may exhibit erratic movements during this period. Price fluctuations are the result of numerous factors, such as the activation of stop losses, profit-taking from the prior trend, and the entry of new traders into the market.

Traders should exercise caution during this phase, as the erratic movements can make it challenging to ascertain whether the reversal is legitimate or a transient retracement.

If traders are unable to accurately identify the new trend, they may be whipsawed by false moves, entering prematurely and exiting rapidly, resulting in losses.

Consolidation and Confirmation

A consolidation phase frequently occurs after a change of character, before the market fully establishes the new trend. A sideways movement or a range-bound market, in which price action fluctuates between support and resistance levels, is typical during this period of consolidation.

During consolidation, traders reassess their positions and establish new levels of equilibrium, allowing the market to “digest” the change. The new market structure is confirmed during the consolidation phase. For instance, in an uptrend reversal, price action may oscillate before breaching a substantial resistance level, thereby verifying the establishment of a new bullish trend.

For those who are willing to wait for confirmation before committing to more substantial positions, this phase can be highly profitable.

Psychological Consequences for Market Participants

The shift in market sentiment that occurs following a CHOC affects traders psychologically. Participants who were previously in agreement with the dominant trend may experience feelings of anxiety or uncertainty. Those who have been caught in the wrong side of the trade may attempt to capture the new trend or close their positions, which frequently results in a self-reinforcing cycle of price movements.

The change in sentiment frequently results in heightened participation from institutional traders, retail investors, and algorithmic traders who endeavor to capitalize on the new trend.

This influx of new participants has the potential to provide liquidity and propel the market in the direction of the new trend. However, it also necessitates that traders remain vigilant of the psychological dynamics at play, including herd behavior and fear of missing out (FOMO).

Modifications to Risk Management

Traders must reevaluate their risk management strategies immediately upon the identification of a change of charactor. If they were previously holding positions that were in accordance with the prior trend, they may need to adjust their stop losses or consider closing out positions to prevent unnecessary risk.

Additionally, individuals who intend to engage in trades in the direction of the new trend must strategically establish their stop losses, bearing in mind that the market may remain volatile during the initial phases of the new trend.

Additionally, traders who depend on automated systems or algorithmic trading strategies may modify their parameters to incorporate the new market conditions. For example, a trend-following strategy might need to adjust its settings to better identify momentum and trends, while a range-bound strategy might need new support and resistance levels to work well.

The Significance of Confirmation Indicators

Although the CHOCH can be a potent signal, it is crucial to await confirmation before making any final transactions. Traders frequently seek additional technical indicators after a CHOCH to confirm the reversal.

MACD (Moving Average Convergence Divergence) crossovers, RSI (Relative Strength Index) moving out of overbought/oversold territory, or moving averages crossing over are among the indicators that may be considered.

By waiting for confirmation, traders can increase their confidence in their decisions and reduce the risk of false signals. It also offers a more precise understanding of whether the market is genuinely changing its character or if the CHOCH was a transient occurrence that was influenced by external factors, such as news releases or economic reports.

Pros and Cons of Change of Character:

Pros:

1. Early Market Shift Detection: By using CHOCH, traders can identify possible trend reversals early on and place trades before the market shifts. If done at the correct moment, this can result in increased profitability.

2. Aids in Risk Mitigation: By seeing a change in market conditions, CHOCH gives traders the chance to get out of lost positions before they cause more losses. This makes risk management more successful.

3. Improved Trend Alignment: Traders can adjust their positions to follow the market’s momentum when the new trend has been validated post-CHOCH, improving their chances of profiting from the trend’s continuation.

4. Versatile in Multiple Markets: CHOCH is a flexible tool for traders in a variety of industries because it can be used in a variety of financial markets, such as stocks, currency, commodities, and cryptocurrencies.

5. Aids in Psychological Adaptation: By preventing traders from clinging to out-of-date patterns that could result in losses, CHOCH recognition aids traders in adjusting to changing market conditions.

Cons:

1. Misleading Signals: CHOCH occasionally generates misleading signals, particularly in markets that are erratic or choppy. For a short time, a market may seem to shift in nature before returning to its initial pattern.

2. Lagging Nature: CHOCH frequently shows up after a sizable chunk of the trend shift has already taken place. Because of this, traders could lose out on the move’s most lucrative portion, particularly when employing shorter periods.

3. Complex Interpretation: It takes a great deal of skill in price movement analysis to recognize a true CHOCH, and even seasoned traders may misread or misidentify the shift, which could result in bad choices.

4. Increased Market Noise: The market may become unstable after a CHOCH, with false breakouts and irregular price fluctuations that can lead to confusion and pointless trades.

5. Emotional Overreaction: Some traders may get unduly anxious to trade following a CHOCH, motivated by the urge to act fast or by FOMO (Fear of Missing Out). Overtrading and rash actions may follow from this.

Change of Character FAQs:

1. What role does CHOCH play in trading?

CHOCH indicates a possible trend reversal and a change in market dynamics. It enables traders to make better selections by helping them predict shifts in the market’s direction.

2. Before making a trade, how can I verify a CHOCH?

To verify the market shift following a CHOCH, traders frequently look for confirmation using additional indications like volume spikes, candlestick patterns (like engulfing candles), or other technical tools (like moving averages).

3. Is CHOCH applicable in every market situation?

Indeed, CHOCH can be used in a range of financial markets and under a variety of market conditions, including volatile ones. To prevent false signals, extra care must be taken during times of extreme volatility.

4. After CHOCH, how can I prevent erroneous signals?

Traders should wait for confirmation from longer timeframes, employ a combination of technical indicators, and exercise caution during market consolidations to prevent misleading signals. Risk management can also be aided by taking profits at strategic points and setting appropriate stop losses.

5. What occurs if I don’t take immediate action following a CHOCH?

You may lose out on lucrative possibilities if you wait after a CHOCH, but you also avoid making a trade that isn’t entirely proven. Making the correct decision requires patience and confirmation.

6. Is CHOCH a trustworthy predictor?

CHOCH is a trustworthy technique for spotting possible shifts in trends, although it is not infallible. Combining it with other tools and indicators is the most effective way to reduce the possibility of false signals and validate market movements.

Change of Character Conclusion:

A useful tool for traders to spot possible trend reversals and changes in market behavior is the Change of Character (CHOCH). Markets frequently experience periods of elevated volatility, consolidation, and a potential shift to a new trend following a CHOCH.

Although this idea gives traders the opportunity to profit from emerging market trends, it necessitates a thorough comprehension of price action, perseverance in waiting for confirmation, and sensible risk management techniques. During these periods, traders should be on the lookout for false signals and the potential for emotional overreaction. Combining CHOCH with other technical indicators offers a thorough approach to successfully managing market fluctuations.

Ultimately, even if CHOCH is a useful tool for traders, it works best when paired with a focused strategy and a solid trading plan.