Candlestick patterns are an important tool for making informed trading decisions. The hammer and inverted hammer patterns are two of the most commonly used candlestick signs.

These patterns frequently serve as solid indications of possible price reversals, giving traders a greater knowledge of market emotion at precise times in time.

Understanding the hammer and inverted hammer will help you improve your trading techniques and navigate market turbulence more successfully, regardless of your level of experience.

This article will explain everything you need to know about the hammer and inverted hammer, including how they form, what they represent, and how to use them in your trading decisions.

What Are the Hammer and Inverted Hammer Patterns?

The hammer and inverted hammer are single candlestick formations that indicate a likely price reversal. These patterns often arise toward the end of a trend, whether bullish or negative, and indicate that a shift in attitude is imminent.

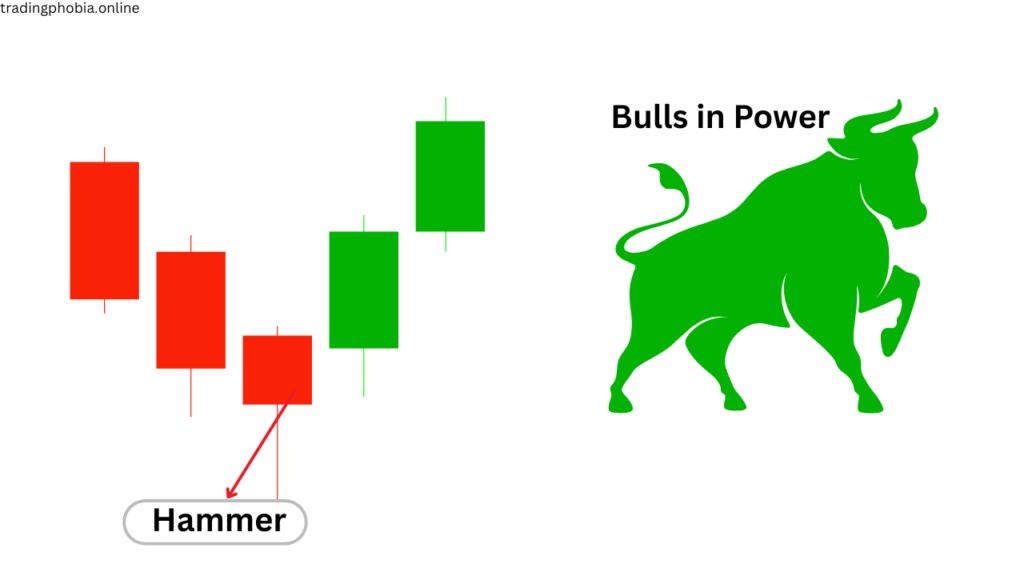

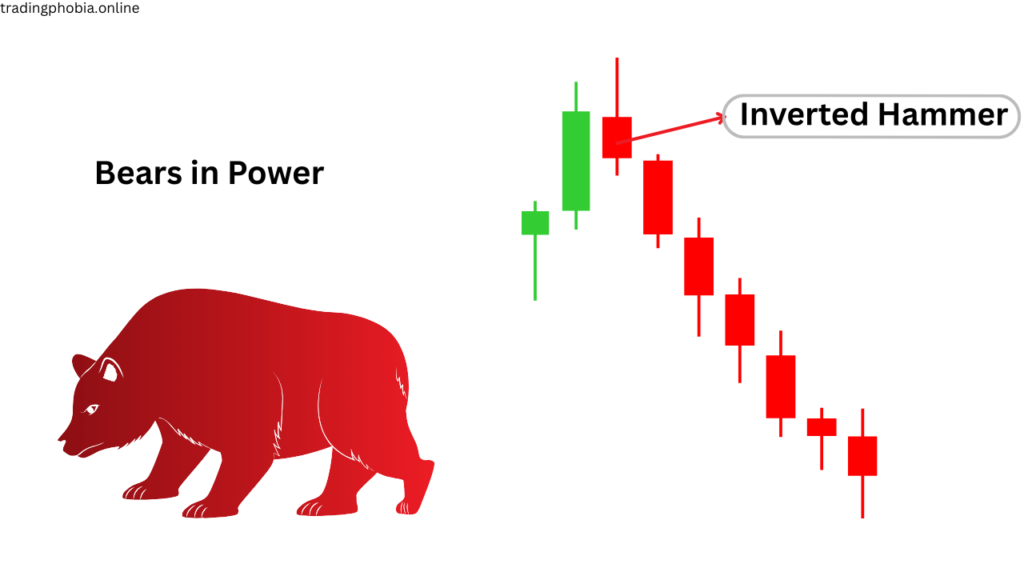

A hammer occurs at the bottom of a downtrend, indicating a bullish reversal, whereas an inverted hammer emerges at the same location but with a different structure and slightly different implications. Both feature a small body and a long wick, but the arrangement of their components differs.

The Hammer Pattern

A hammer candlestick has a small body toward the top of the trading range and a long lower shadow. The crucial visual cue is that the lower wick should be at least twice as long as the body. This data suggests that, despite sellers driving prices lower during the session, buyers stepped in and pushed prices back up, indicating a shift in momentum from bearish to optimistic.

For example, if a stock has been in a prolonged downturn and then forms a hammer, it may indicate that selling pressure is easing and a bullish reversal is likely. Many traders use this pattern to enter long positions or exit short positions.

The Inverted Hammer Pattern

In contrast, the inverted hammer has a short body at the lower end of the trading range and a long upper wick. It emerges after a downturn and may indicate a potential bullish turnaround, though it frequently requires confirmation from the next candle.

What distinguishes the inverted hammer is its psychology:

Sellers attempted to lower prices, but purchasers resisted and briefly gained control; however, they were unable to keep it by the end. This tug-of-war causes uncertainty, but it can also be a strong reversal signal if confirmed by future market movement.

Psychology Behind Hammer and Inverted Hammer:

To fully comprehend the hammer and inverted hammer, it’s necessary to understand the market psychology they represent.

In the case of a hammer, the market begins and maintains its downward trajectory. However, buyers enter the market aggressively, driving prices back up and closing near the opening price. This quick shift indicates that bulls may be gaining control.

Using an inverted hammer is more of a testing process. Buyers successfully drive the price upward after the open, while sellers fight back. Even though the candle closes lower than the high, the fact that buyers were able to apply such pressure following a downturn indicates that sentiment may be shifting. The inverted hammer frequently requires a bullish confirmation candle to substantiate its message.

How to Trade With hammers and Inverted Hammer Patterns:

Using the hammer and inverted hammer successfully demands more than simply identifying them on a chart. You must examine context, volume, trend direction, and confirmation.

When you see a hammer at the bottom of a downtrend, the first step is to look for confirmation—a bullish candle that closes above the hammer’s body. Volume is also an important consideration here. A hammer generated with high volume has more weight than one formed with low trading activity.

For the inverted hammer, confirmation is much more important. This pattern does not provide a strong purchase signal unless the following candlestick exhibits bullish continuation. A gap up or a strong green candle after the inverted hammer lends credibility to the signal.

Traders frequently place stop-loss orders below the hammer’s or inverted hammer’s wick to defend against false signals. Profit goals can be set based on local resistance levels or a predetermined risk-to-reward ratio.

Examples of Hammers and Inverted Hammers in Real Life:

Let’s examine a few imaginary but possible instances.

Take the example of a stock that has been declining for a few weeks. A hammer appears on the daily chart one day. The price confirms the reversal the following day as it rises higher and keeps rising all day. A trader may have a fantastic chance to enter a long position at this time.

Now imagine the same scenario, but with a hammer upside down. An inverted hammer forms, and the price has been dropping. The market experiences an upward gap and closes strongly the following day. An astute trader may decide to take a long position with a stop-loss slightly below the low of the inverted hammer, since this confirmation suggests a potential trend reversal.

Typical Errors When Using Hammers and Inverted Hammers

Relying solely on the hammer and inverted hammer without taking the wider picture into account is one of the biggest mistakes traders make. A solitary candlestick needs context to be a miracle signal.

For instance, it doesn’t indicate much to see a hammer in the midst of an uptrend or sideways market. The pattern works best when it emerges toward the conclusion of a downward trend. Likewise, without confirmation, an inverted hammer is merely a warning sign rather than an invitation to enter.

Ignoring loudness is another frequent mistake. Volume provides important details regarding the pattern’s strength. Compared to a hammer and inverted hammer made on high volume, one formed on low volume is significantly less reliable.

The Reasons Behind the Popularity of the Hammer and Inverted Hammer

The hammer and inverted hammer designs are popular because they are easy to use and efficient. These patterns can give early indications of a reversal and are simple to identify. They function well on intraday charts as well as weekly timeframes and can be incorporated into nearly any trading strategy.

Furthermore, the hammer and inverted hammer work especially well when combined with other technical indicators such as support/resistance levels, MACD, or RSI. The hammer and inverted hammer become even more effective trading tools when multiple indicators line up.

Using Inverted Hammer and Hammer in Your Strategy

With a methodical approach, every trader should think about including the hammer and inverted hammer in their toolkit. Always seek confirmation, take into account the larger market environment, and use additional technical tools in conjunction with these patterns.

Over time, using these patterns regularly and in conjunction with appropriate risk management techniques will improve your decision-making and produce better trade results.

Hammer and Inverted Hammer Pros & Cons

Pros

- Simple to Identify: On any chart, both patterns are easily identifiable due to their visual distinctions.

Early Reversal Signals: These signals often indicate a potential trend shift before it fully materializes.

Useful in various Markets: Perform well in commodities, currency, stocks, and cryptocurrencies.

Multipurpose: Adaptable to intraday, daily, weekly, and even monthly charts.

Excellent for Novices: very little technological expertise to comprehend and use.

Gratitude Other Tools: Perform well in conjunction with trendlines, RSI, MACD, and volume analysis.

Improves Entry Timing: This analysis improves risk-to-reward by assisting traders in entering positions near possible reversals.

Adds Confirmation Layer: It improves trade accuracy when combined with other patterns or signals.

Cons

- Not Always Reliable Alone: If utilized incorrectly or without confirmation, it may send out erroneous signals.

Weak volume during pattern creation diminishes reliability; hence, volume support is required.

Compared to the hammer, the inverted hammer is weaker and requires more proof.

It can Be Deceptive in Sideways Markets: This strategy is less effective when prices are in a range-bound or stabilizing state.

Subjectivity-prone: Depending on the trader’s background, interpretation may differ.

Delayed Confirmation: Traders may miss rapid moves if they must wait for the following candle.

Not a Standalone Strategy: It shouldn’t serve as the only justification for making or breaking transactions.

Hammer and Inverted Hammer Conclusion

The hammer and inverted hammer are two of the most powerful yet straightforward candlestick patterns that every trader should be familiar with.These patterns frequently indicate prospective market reversals and assist traders in predicting market movements before they occur in their entirety.

These patterns frequently suggest potential reversals, allowing traders to anticipate market movements before they occur. A hammer indicates that buyers are stepping in following a slump, implying a positive reversal. On the other hand, the inverted hammer indicates that purchasing interest is returning, albeit it frequently requires more confirmation to move on.

When utilized correctly, both the hammer and the inverted hammer can be useful tools, especially at support levels or after a long downturn. They give traders an advantage, particularly when paired with other indicators such as volume, RSI, or trendlines. However, no pattern is perfect, and they are no exception. False signals can occur, particularly in low-volume or sideways markets.

To trade with confidence, avoid relying entirely on the hammer and inverted hammer. Use them as part of a larger technical strategy, and always confirm their indications before making a trade.

With proper study and discipline, these patterns can help you make better decisions and identify high-probability opportunities across marketplaces.Mastering the hammer and inverted hammer will bring you one step closer to trading with precision and purpose.