The trading world can frequently feel difficult, particularly when you come across ideas that initially seem complicated. One such phrase is “Order Block,” which is a key idea in technical analysis, particularly when discussing price movement and market structure.

Knowing order blocks can significantly enhance your trading approach, regardless of your level of experience, as they offer valuable information about potential price reversals and consolidations.

We will go into excellent detail about order blocks in this post, including their significance, how to spot them, and how to use them in your trading strategy.

What is an order block?

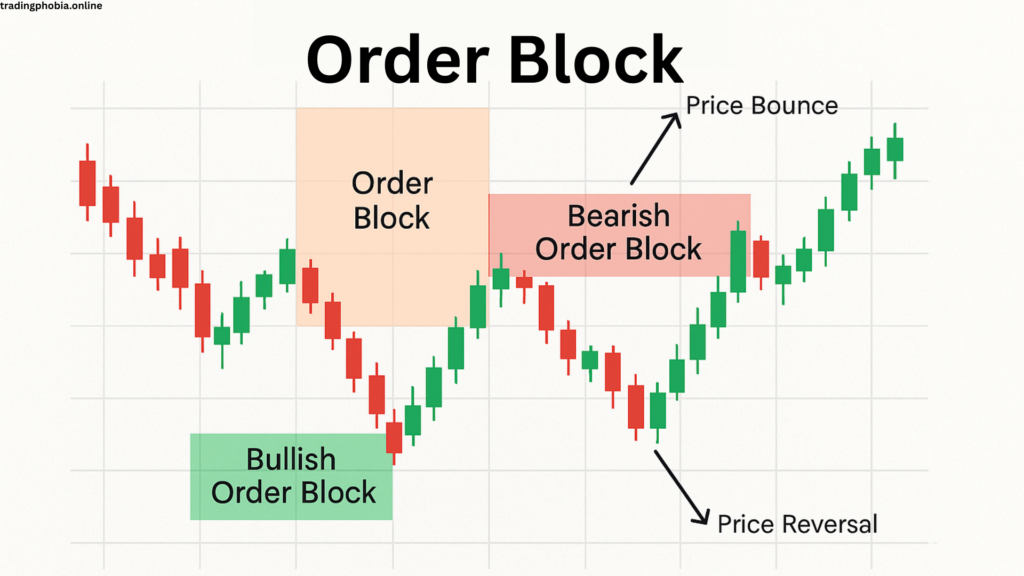

To put it simply, an order block is a particular zone or price range on a chart where large buying or selling orders have previously been placed. These orders are typically issued by market makers or major institutions, and they are frequently regarded as places of strong resistance or support. Depending on the order flow, the price may either reverse direction (resistance) or bounce off (support) when it returns to these levels.

In essence, an order block is the market’s method of displaying the locations of high order execution volumes; these levels typically have particular meaning for future price movements. Traders use these regions to forecast future market moves, particularly when there are trend reversals or pullbacks.

Institutional Orders Function in Order Blocks

The concept of order blocks closely relates to institutional trading.

Institutions such as hedge funds, banks, and giant investors operate on a much wider scale, executing trades that can have a significant impact on the market, whereas retail traders tend to concentrate on narrower time frames and patterns.

Large orders placed by these institutional traders frequently leave traces on the chart that resemble order blocks. Typically, these traders place sizable buy or sell orders across a variety of prices.

The market may turn around once these orders are placed, establishing a fresh level of support or resistance that individual traders might identify and respond to.

Since these institutional orders frequently determine the course of future price action, it is essential to understand their location.

Depending on the mix of buying and selling orders, the price may either continue its trend or reverse when it returns to an order block.

How Order Blocks Are Spotted

It’s not as hard as it might seem to identify order blocks on a chart. You should search for a few essential aspects, which are usually more noticeable on longer time frames (e.g., 1-hour, 4-hour, or daily charts). The following are some typical traits:

- Big Candlestick Actions:

A big candlestick or sequence of candlesticks is frequently the initial indication of an order block. These candlesticks usually indicate a big order flow by displaying tremendous momentum in a single direction. When you see these big candles, zoom in on the region where they formed, as it may indicate an order block.

- Reversals in Price Following an Order Block:

Sharp price reversals frequenAfter filling a sizable order block, the price may retrace to the execution level. Depending on the order flow and current market trend, the price may either revert or bounce off this point.

- Zones of Consolidation:

Before making a significant move in one direction, the price may occasionally consolidate within a range following the formation of an order block. These consolidation zones can also function as possible order blocks because they show market hesitancy, which often results from institutional traders positioning themselves for their next big move.

- BOS, or Break of Structure:

When the price breaches a significant level of support or resistance, a Break of Structure (BTThis sign often indicates that an order block has been created. The price usually moves strongly in the direction of the breakout, and these breaks usually come after a lengthy period of consolidation.

- Sound level:

Another indication of order blocks is high volume. Big orders tend to increase volume, indicating the presence of institutional traders. An abrupt increase in volume and a subsequent price change may signal the formation of an order block.

Types Order Block

Traders should be aware of the following two primary types of order blocks:

- Blocks of bullish orders:

When a strong buy order is executed within a particular price range, the price rises, creating a bullish order block. These order blocks indicate possible support regions and are usually produced during an uptrend. The price may serve as support when it retraces to this level, giving traders a chance to purchase the asset at a discount.

- Blocks of bearish orders:

The reverse is a bearish oA sizable sell order at a specific price range triggers its development, leading to a price drop.ice to drop. Usually observed during a downward trend, these order blocks indicate possible resistance levels. The price may serve as resistance when it retraces to this level, giving traders an opportunity to sell the asset for more money.

How Order Blocks Are Used in Trading

How are order blocks used in trading now that we know what they are? You can successfully use the following tactics when dealing with trade order blocks:

- Pullbacks in order blocks:

Waiting for a retreat to a designated order block is a popular tactic. Wait for a pullback to a bullish order block if the price is rising, and then watch for indications of a reversal (e.g., an oscillator’s confirmation or a candlestick pattern). In a decline, the same holds true for bearish order blocks.

- Price Action Confirmation:

Identifying an order block by itself may not be adequate. Always seek confirmation of price movements. Look for bullish or bearish candlestick patterns, such as engulfing candles, pin bars, or doji candles, for instance, when the price crosses an order block. These patterns frequently indicate that a price reversal from the order block is likely.

- Order Block Breakout:

Trading the breakouts of order blocks is an additional strategy. The market may be beginning a new phase if the price breaks through an order block, and it will likely continue in the breakout’s direction. After the breakout is confirmed, traders frequently put buy or sell orders above or below the order block.

- Confirmation Through Indicators:

Technical indicators such as the RSI, MACD, or stochastic oscillators can also be used to verify whether an order block is legitimate. For instance, the RSI may be another indication to go long if it is oversold close to a bullish order block. Similarly, if the MACD exhibits bullish convergence near a bearish order block, it could signal a significant reversal.

Key Errors to Avoid When Trading Orders Block

Order blocks are an effective trading technique, but it’s important to utilize them carefully. Traders frequently make the following errors when utilizing order blocks:

- Not Making Use of Extended Time Frames:

Attempting to spot order blocks on shorter time frames, where price movement is frequently more unpredictable, is a common mistake made by traders. Higher time frames, when institutional activity is more apparent, yield more dependable order blocks.

- Ignoring the context of the market:

The larger market context determines the significance of an order block. For example, there is less possibility of a reversal at an order block if the general trend is strong. Always consider the current market trend when trading order blocks.

- Excessive Dependence on Order Blocks:

Order blocks are a useful tool, but your trading strategy shouldn’t be built around them exclusively. To make your trades more reliable, always combine them with other types of analysis, like trend analysis, support and resistance levels, and technical indicators.

- Failure to Manage Risk:

Risk management is essential to every trading strategy. When trading close to order blocks, set stop-loss orders to guard against unforeseen price movements. Order blocks may be excellent places to start, but no strategy is foolproof.

Order Blocks in Trading Pros and Cons

Pros:

- Institutional Knowledge: Retail traders can learn where the “smart money” is trading by looking at order blocks, which frequently show institutional activity.

- Better points of entry and exit help traders identify potential breakout or reversal zones, which can improve their trade timing.

- Greater Opposition and Support: These regions typically provide more dependable support and resistance levels compared to conventional horizontal lines.

- Clarity of Reversal and Trend larity of Reversal and Trend ContCrosses Markets: Crosses Markets: This platform is adaptable to a variety of asset classes, including equities, commodities, Crosses Markets: This platform is adaptable to a variety of asset classes, including equities, commodities, cryptocurrency, and foreign exchange (FX)ange (FX)e (FX) (BOS).

- Crosses Markets: Adaptable to a variety of asset classes, including equities, commodities, cryptocurrency, and FX.

- Improved Ratio of Risk to Reward: Traders can frequently aim for better R:R setups with more accurate entry and stops.

Cons:

- Identification Subjectivity

There is no set rule; thus, various merchants may designate different zones as order blocks.

- Confirmation Lagged

Price action or indicator confirmation might postpone entry and occasionally result in lost opportunities.

- Higher Time Frame Analysis Is Needed

Longer time frames are typically required for effective identification, which some intraday traders may find restricting.

- Not Infallible

Price may give deceptive signals and not always respect an order block.

- Excessive Dependency May Be Dangerous

Making bad trading judgments could result fsolelyrelying only on order blocks without doing more thorough research.

- Increasing the complexity of identifying and tracking multiple order blocks can clutter the chart, making analysis more challenging.

difficult.

Order Block in Trading FAQs

Q1: Do order blocks appear only dutimestime periods?

A: They can be observed on shorter time frames, but they are more dependable on higher time frames, such as H1, H4, and datimestimes, however, lessen misleading signals and noise.

Q2: What distinguishes order blocks from conventional resistance and support?

A: Historical highs and lows serve as the foundation for traditional support and resistance levels. Order blocks provide additional context and relevance by being based on zones where institutions most likely placed sizable buy/sell orders Would it be possible

Would it be possible to trade order blocks without the use of indicators?

A: You can utilize order blocks with just pr However, you can increase accuracy, though, by verifying them using indicators like RSI or MACD.

Q4: Do reversals always result from order blocks?

A: Not at all. The price may momentarily respect an order block before breaking through. Be sure to get confirmation before making any trades.

Q5: Which indicator works best for order blocks?

A: When identifying divergence or convergence, order block setups are frequently confirmed using RSI, MACD, and volume indicators.

Order Block In Trading Conclusion

Order blocks are a potent concept that is deeply anchored in institutional trading behavior and provides retail traders with a more profound understanding of market structure. Traders can more accurately predict potential reversals, continuations, or key reaction areas by identifying zones where significant buy or sell orders were placed.

Incorporating order blocks into your strategy can enhance your entry and exit timing, particularly when used in conjunction with tools such as volume analysis, price action confirmation, and Break of Structure (BOS), regardless of whether you are trading forex, equities, or However, like any strategy, one should not employ order blocks in isolation.

anyy strategy. Always take into account the broader market context, employ extended time frames for reliability, and implement appropriate risk management. Order blocks can be a valuable addition to your trading toolkit—enabling you to trade in tandem with the smart money, rather than against it—with the proper approach and practice.